2 min read

Have You Met MARC?

The SBA’s newest tool is here to help you support small manufacturers and grow your lending portfolio. Big banks are turning away small businesses. ...

Why is the penny being retired?

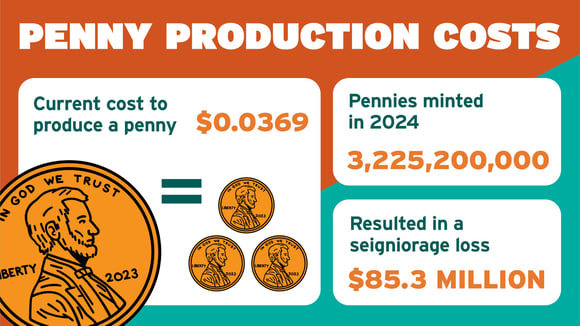

The main reason is the high manufacturing costs of production.

Producing a penny costs about 3.69 cents. In 2024, the U.S. Mint reported a seigniorage loss – meaning the difference between the coin’s face value and its production costs – of $85.3 million.

Another reason is that in the U.S., roughly 41% of people don’t use cash during the week.

The U.S. Mint stopped production of the penny yesterday (November 12, 2025). However, pennies will still be considered legal tender. There are about 114 billion in circulation, so it might take a long time before they are completely phased out

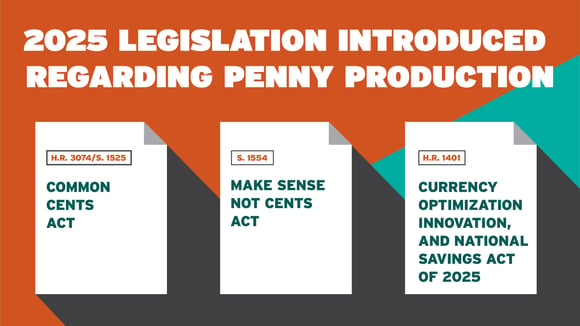

These are just a few of the proposed legislation to eliminate or suspend penny production. See details here.

What do you notice?

Issue #1: Since this is a tiered account, this ad needs to include the balance requirement to earn the APY and it must be in close proximity to the APY.

Reg. DD requires the corresponding minimum balance to be included in close proximity to the APY for each tier. (Note: You can highlight one tier and its corresponding balance — the rest can be included in your disclosure.)

Issue #2: When seeing the ad, it appears that anyone could open the account and get this rate. However, this account has three qualifications the customer must meet every month to receive this APY.

Our Recommendation for #1 and #2: Under the 2.01% APY add something like: “On balances up to $____ when you meet qualifications.” Another option: “On balances up to $______. Terms apply.” This lets the reader know that there are qualifications. Then they can get details one click away.

Additional Insights:

At this point, it is not clear. Everyone is waiting for final legislation. Some stores have been rounding up to the nearest nickel and others are rounding down. However, it appears that some states may have prohibited rounding to the nearest nickel.

What is your next step?

Need help developing a plan or supporting education and marketing materials?

Let’s talk!

Sources:

2 min read

The SBA’s newest tool is here to help you support small manufacturers and grow your lending portfolio. Big banks are turning away small businesses. ...

2 min read

Over the years, digital advertising has grown and so have compliance challenges. Many regulations have not been modernized to reflect the digital...

3 min read

Note: This article was written featuring insights from Becki Drahota, Mills CEO. Considering a merger or acquisition? You’ll need the recipe for...