2 min read

One-Liners to Pay Attention to This Year

Each year Bank Director sponsors a number of conferences to inform bank directors and senior leaders on a variety of topics. The Acquire or Be...

Hi everyone!

Just got back from attending the Acquire or Be Acquired Conference (AOBA) and the following is a distillation of my notes from the conference. Major themes were using Positive Pay to attract new business accounts via a fraud protection theme, looking at deposits as a profit center, not just loan funding, and bringing in AI to dramatically improve efficiency.

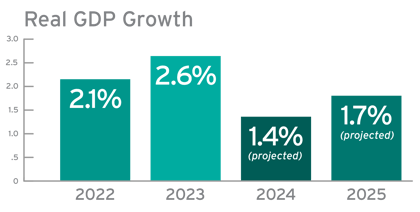

Unemployment: 4.2%

Fed Rate Change: 2 expected this year

The banking crisis of 2023 is over (every 15 years there is one) and 4,700 banks got it right.

In 2023 the Private Credit Industry grew by $1T.

In 2008, 8 of 10 mortgage originations were banks. Today, that percentage is 20%.

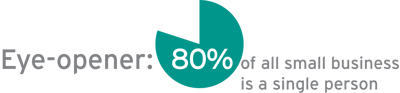

The industry is consolidating at 4%/year (very few new banks).

The gap between the number of banks and CUs has collapsed.

In 2023 there were 15 M&A deals.

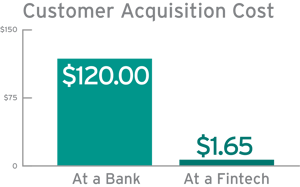

88% of US consumers use fintech apps.

65% of US consumers use digital banking.

18% of banks have the tools to serve Gen Z.

A New Lens: Today the bank is a thing, not a place.

TO DO: PURGE INACTIVE ACCOUNTS EVERY 6 MONTHS; YOU’RE PAYING FOR THEM IN 4-6 PLACES

The most important issue to address now is to establish an internal policy about your use of AI.

Next, make sure you’re developing AI to meet a specific strategy. Who do you want to be 5 years from now? What legacy processes are holding you back? (Ex. Getting data fast) How do you direct and re-direct resources to drive value?

Several speakers had the following suggestions: Start small, start simple. Automate the things you can’t do in person.

Consider this example:

6.7M people in the financial industry earning an average of $70K/year = $½ billion of “people expense” in tellers and CSRs. AI can do programmed work at less than a penny per nanosecond.

One bank recommended using AI to consistently improve your Banking Security Act activities. Another reminds us:

“Embracing change doesn’t mean running headlong into it.”

-BUT-

“You don’t get fit looking at other people going to the gym.”

-Daragh Morrissey, Microsoft

Great question, great answer

Q: Why should we get into AI?

A: From Brian Moynihan, BofA Chair and CEO, “Because 180M users asked Erica, ‘What’s my routing number?’”

A little about BaaS ...

And finally, here's the download on M&A:

Favorite M&A Quote: Selling is a game of musical chairs. Make sure you have one.

(FYI: Customer attrition average is now 6-7%)

Favorite Quote:

“The most dangerous person in the room is the one who can be confidently wrong.”

Let me know if you want me to give you more detail!

2 min read

Each year Bank Director sponsors a number of conferences to inform bank directors and senior leaders on a variety of topics. The Acquire or Be...

2 min read

Today, most markets are overrun with similar product offerings amongst competitors, making it challenging to enter new markets. And digital...

3 min read

Using data to drive communications. Research has shown that complicated checking accounts are both difficult to sell, and unattractive to consumers....