5 min read

How to Create High Impact Video Marketing Content

Engaging. Provocative. Compliant. There’s no denying that well-produced video has enormous marketing value, but the process of creating it can be...

2 min read

Becki Drahota

|

August 15, 2022

Becki Drahota

|

August 15, 2022

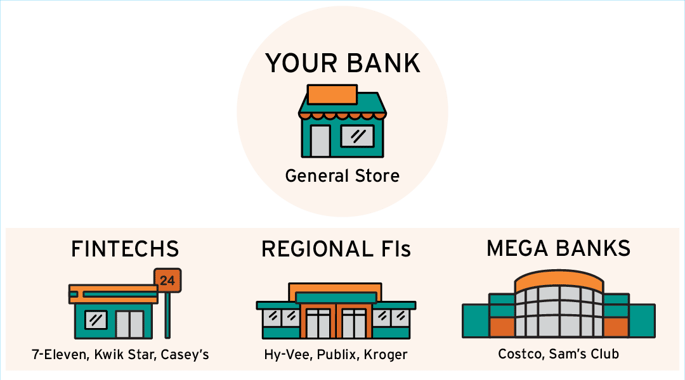

Mega-Banks, major regionals and fintechs know their value proposition. Are you sure you know yours?

Here’s an out-of-industry metaphor to illustrate:

As the General Store, you’re the resource for people who live near you to get the basics when they can’t access another provider. You know where I’m going here. The entire General Store business model rests on the premise of physical location being a competitive advantage. Today, anyone can bank from anywhere, anytime, and a lot of us do just that.

To secure sustainability, we General Stores must dig deep to discover our relevance and purpose in today’s world.

Here’s a roadmap to guide you:

Address your plethora of platitudes.

You probably have a number of enterprise-wide messages percolating through the organization. From mission, vision and values to brand, your team is hearing a lot (and probably retaining precious little) of declarative and aspirational messages. You’re asking employees to sort, recall and execute behaviors rooted in messages which have specific or limited relatability. It may sound counterintuitive but adding one more message, your value proposition, will help resolve that confusion.

Enter the value proposition. Learn what it is and create one.

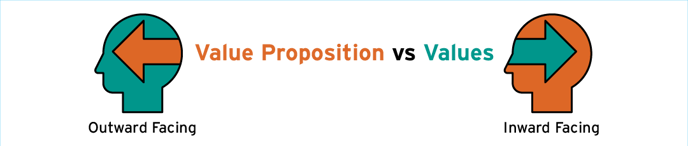

A value proposition is different from your core values, mission statement and vision statement. Your value proposition identifies who you target and why you can serve that target better than your competitors. It’s the last part that’s critical here. Answering the “why” forces you and your FI to recognize the strength of your differentiation and challenge beliefs like, “we’re the best” that may not be substantiated.

Value propositions exist at the macro and micro levels, and help employees focus on activities that drive revenue. A value proposition is an external facing statement. It should always focus on how customers define your value.

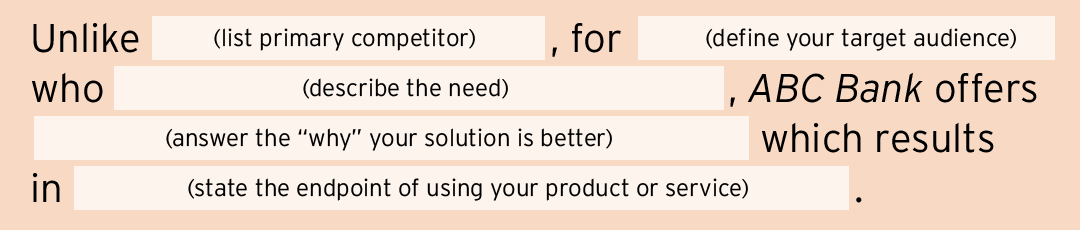

Sample value proposition template:

By following the template you’ll be able to see if your offering has relevance and a discernible advantage. The journey to achieve a valuable (excuse the pun) value statement often takes major introspection, and may require changes in product pricing, features and design.

A word of caution. Organizational routines and industry homogeneity may be rocks in the road when you’re creating your value prop. Offering a truly better solution may require extensive back-end support and an anti-inertia mindset. It is not for the faint of heart and can’t be done overnight.

What if you find out you don’t have a value proposition?

Don’t panic. You have options.

Finally, make sure you are right.

Test drive your value proposition with your target customers to make sure you’re providing not only what they value, but also bringing a depth and breadth to that value which is significant or unique enough so they prefer your product over that of your competitors.

Creating value is at the core of banking. Value for shareholders. For stakeholders. And value for your financial institution’s future sustainability.

Taking the time to discover your true value proposition is mission-critical for you to really know who you are and how capable you are to deliver what you need to thrive.

5 min read

Engaging. Provocative. Compliant. There’s no denying that well-produced video has enormous marketing value, but the process of creating it can be...

2 min read

I live in Iowa. Just like you, we’re going through COVID, we’ve had political unrest, we’ve experienced demonstrations. And in the midst of all these...

2 min read

When it comes to brand value, the financial industry is and has been behind the curve for a while. In fact, compared to all major industries, ...