2 min read

Acquire or Be Acquired: 2024 Takeaways

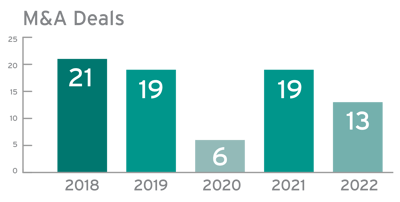

Here are some key insights on the state of the financial industry. Hi everyone! Just got back from attending the Acquire or Be Acquired Conference...

And finally …

My own humble opinion: Make M&A a line item in your board/senior team meetings. You don’t have to be actively looking to buy or sell, but you need to stay current about what opportunities/challenges are currently happening in this arena, and how it might affect you.

Cheers!

Becki

2 min read

Here are some key insights on the state of the financial industry. Hi everyone! Just got back from attending the Acquire or Be Acquired Conference...

3 min read

Using data to drive communications. Research has shown that complicated checking accounts are both difficult to sell, and unattractive to consumers....

3 min read

Note: This story also features insights from Rhonda Handy, VP, Risk and Compliance. A newly announced savings opportunity aims to help families start...