2 min read

How to Leverage Canva® for Consistent, On-Brand Marketing

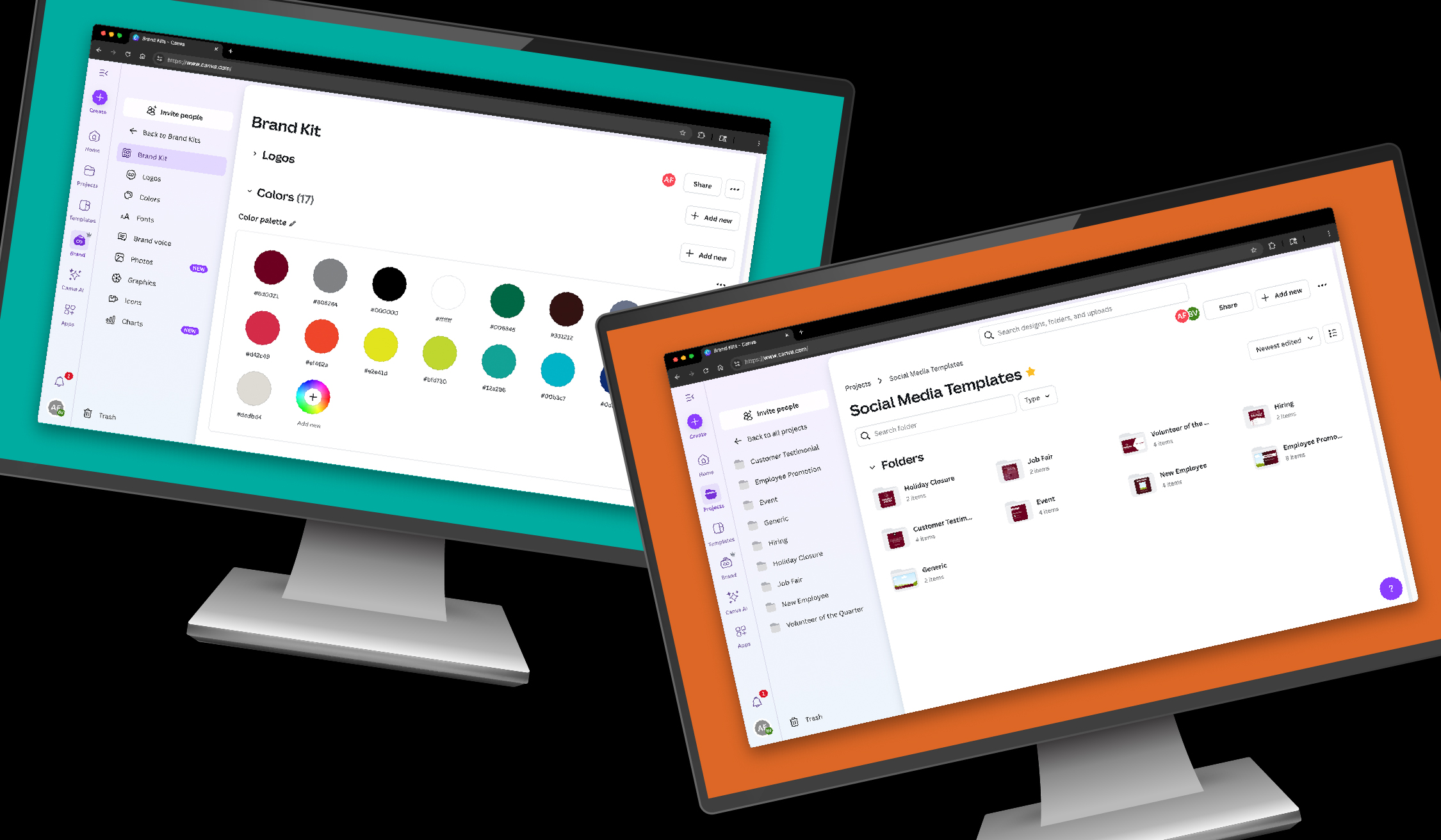

Plus, follow these three pro tips for maximizing Canva’s capabilities at your FI. In today’s fast-paced digital landscape, visual content is...

2 min read

Heather Stahl

|

July 21, 2025

Heather Stahl

|

July 21, 2025

Social media marketing has become increasingly popular with today’s mortgage lenders. It provides a platform for reaching a wider audience and can generate leads, drive website traffic, and increase the visibility of your institution’s brand. This can be a great tool for mortgage lenders to promote your offerings.

However, without clear guidelines regarding how and what can be published – along with proper monitoring measures – posting can land your institution in hot water … and potentially lead to large fines.

When promoting mortgage lending, it’s important to know and follow the rules related to the following regulations:

Here are some no-go’s when writing loan-related advertising posts …

Also, be aware of RESPA’s guidelines for relationships with realtors.

Avoid these potential RESPA-related compliance issues:

Here are a few practices your institution can implement to help your social media compliance.

Schedule a meeting with your lending and compliance teams to discuss what you’ve learned in this article and how you can all work together to be successful.

Do you have questions about this topic or other compliance-related items?

2 min read

Plus, follow these three pro tips for maximizing Canva’s capabilities at your FI. In today’s fast-paced digital landscape, visual content is...

2 min read

The SBA’s newest tool is here to help you support small manufacturers and grow your lending portfolio. Big banks are turning away small businesses. ...

3 min read

Note: This article was written featuring insights from Becki Drahota, Mills CEO. Considering a merger or acquisition? You’ll need the recipe for...